CFA Course Programme Overview

-

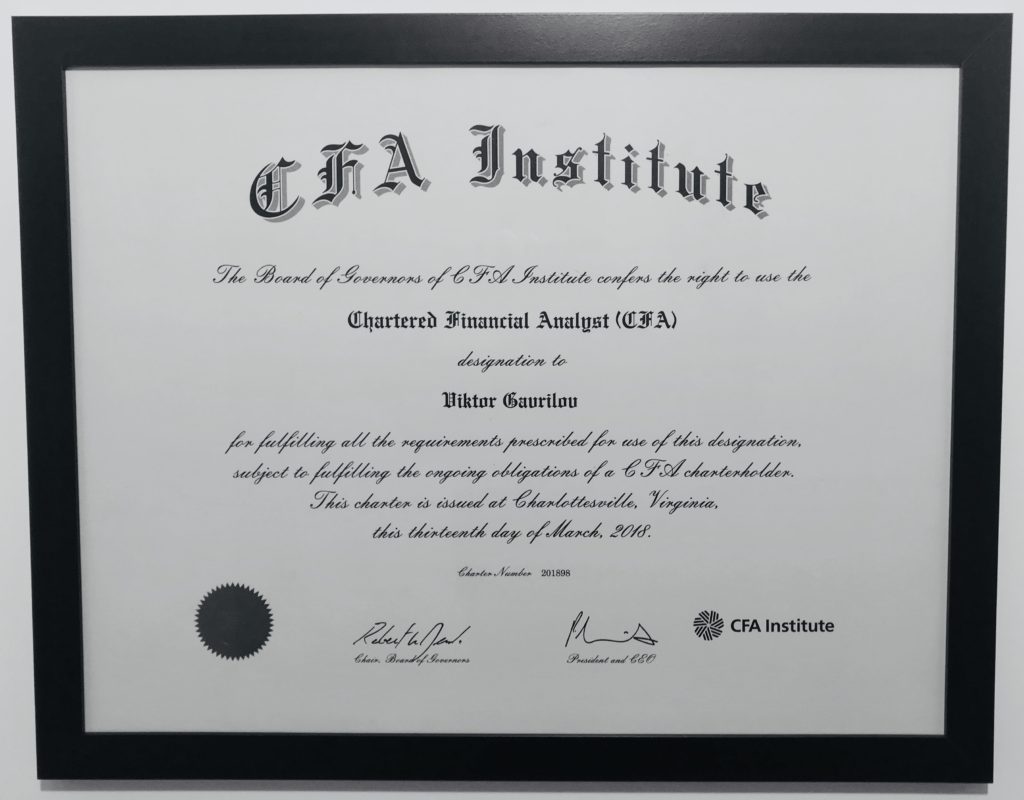

Global Certificate

-

3 Levels | 10 Subjects

-

2-3 years timeline

-

Qualified Faculty Pool

-

In-house Learning Management software

-

Personalised Study Plan

-

Training and Internship opportunity

-

Opportunities in India and abroad

To become a charter holder, candidates must pass three exams, have a bachelor’s degree, and have at least four years of relevant professional experience.

Lets start the career with Invisor!

Level 1:

- Ethical and Professional Standards (15% -20%)

- Quantitative Methods (8% -12%)

- Economics (8% -12%)

- Financial Statement Analysis (13% -17%)

- Corporate Finance (8% -12%)

- Equity Investments (10% - 12%)

- Fixed Income (10% - 12%)

- Derivatives (5% -8%)

- Alternative Investments (5% - 8%)

- Portfolio Management & Wealth Planning(5% -8%)

Level 2:

- Fixed Income (10% -15%)

- Derivatives (5% - 10%)

- Alternative Investments(5% -10%)

- Portfolio Management and Wealth Planning(10% -15%)

- Ethical & Professional Standards(10% -15%)

- Quantitative Methods(5% - 10%)

- Economics(5% -10%)

- Financial Statement Analysis (10% - 15%)

- Corporate Finance (5% - 10%)

- Equity Investments (10% - 15%)

Level 3:

- Ethical & Professional Standards(10% -15%)

- Economics(5% -10%)

- Equity Investments (10% - 15%)

- Derivatives (5% - 10%)

- Alternative Investments(5% -10%)

- Fixed Income (15% - 20%)

- Portfolio Management and Wealth Planning(35% -40%)

Exam Pattern of CFA Course

Level 1

90 MCQs each session | 2 hours 15 mins each session

Exam Windows : February, May, August, November

Level 2

44 Vignettes each session | 2 hours 12 mins each session

Exam Windows : February, August, November

Level 3

Vignettes & Essay questions | 2 hours 12 mins each session

Exam Windows: May, August

Eligibility Criteria

Minimum eligibility criteria for the program

- Candidate should hold a bachelor’s degree or should be in the final year or should have relevant 4 years of work experience.

- A valid international travel passport.

Program Fee

- Type Of Fees

- Material Fee

- CFA Exam Fees (Payable to CFA Institute)

- One Time Registration Fee

- Level

I - INR 29,000

- $1000

- level

II - INR 29,000

- $1000

- $450

- Level

III - INR 29,000

- $1000

Our Alumni work at

Students Feedback

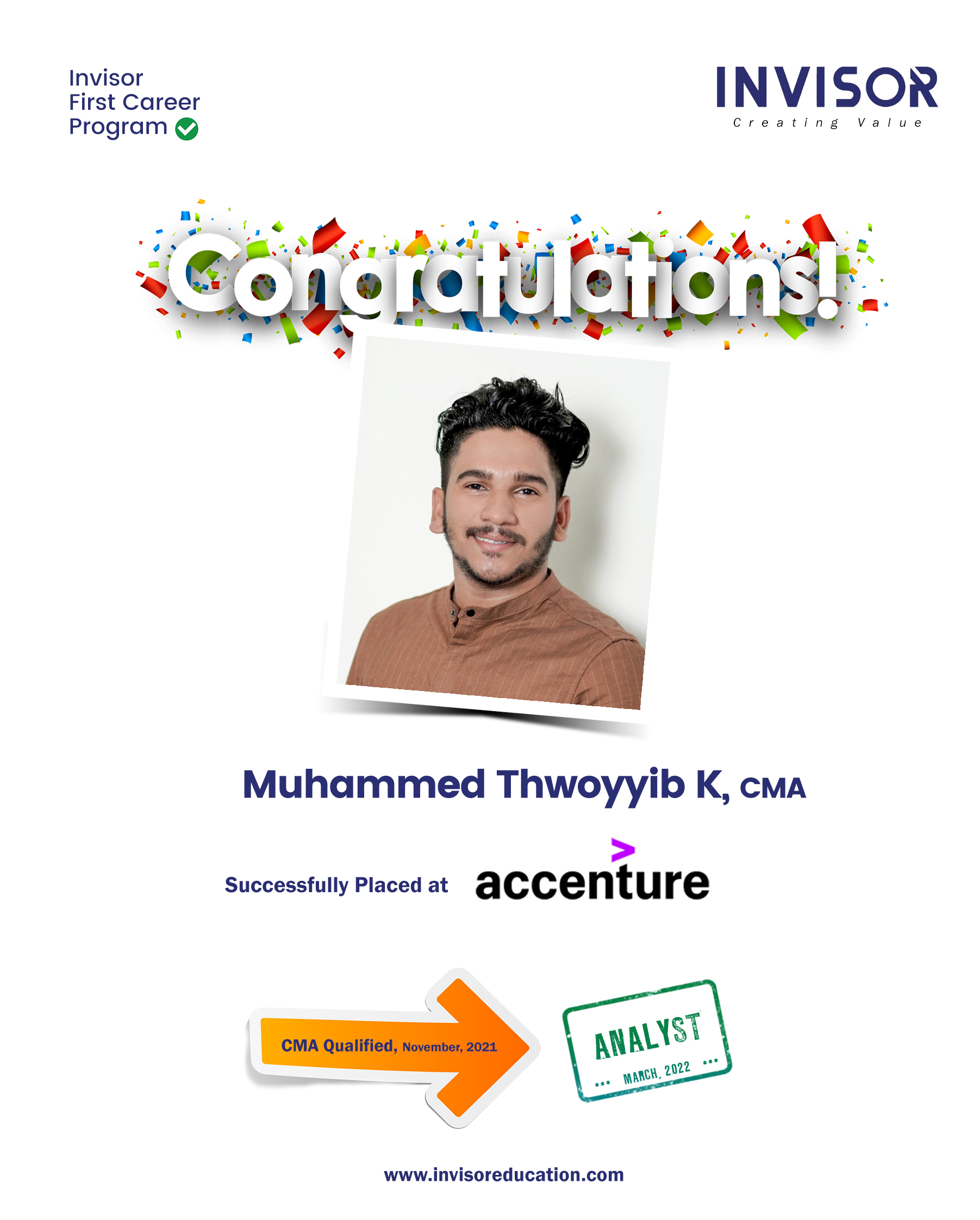

2022 Placements

Similar Programs

FAQS about Chartered Financial Audit (CFA) Course

-

What is CFA charter?

The Chartered Financial Analyst® (CFA) charter is a professional designation (not a degree) issued by the CFA Institute after three levels of credentialing exam in order: Level I, Level II, and Level III. It is the most respected designation to get recognized as an investment management designation. CFA India is a recognized community of stockbrokers and investment bankers leading the market for the wealth management domain

-

How many papers are for CFA?

From 2021, CFA level exams follow computer-based testing. CFA level I contains -180 multiple- choice questions, to be completed within 2 hours and 15 minute session times. CFA level 2 exam format is also the same as the CFA level 1 exam, the questions are divided into question sets, where half of the item is set in the morning and a half in the afternoon. To solve the questions, you will need to use the information provided in each item set. CFA Level III test is also computer-based and includes both a morning and afternoon session’s course duration at each level is approximately 6 months. For 3 CFA-level courses, the CFA certification timeframe is 2 years on average. For CFA level III, the morning session contains 8-15 essay-style questions or constructed response questions, each with various elements to help you organize your response. The questions assess your ability to apply the curriculum in the real world by presenting you with a scenario to solve or advise on. Item sets, comparable to CFA Level II, are featured in the afternoon session. Each item set starts with a case statement, followed by four to six multiple-choice questions about the statement.

-

What is the duration of CFA course?

CFA course duration at each level is approximately 6 months. For 3 CFA-level courses, the CFA certification timeframe is 2 years on average.

-

What are the requirements to become a CFA Charter?

To become the CFA Charter holder, the candidate must complete all three levels of CFA examination along with 4 years of relevant professional work experience

-

What are the requirements to appear for CFA exam?

There is a $185 fee per part paid at the time of appointment scheduling. The test fee is non-refundable and non-transferable.

- Pursuing the last year of graduation

- Have 4 years of relevant work experience in the investment banking/wealth management

- Any graduation

- A valid passport

-

What are the requirements to become a CFA Charter?

To become the CFA Charter holder, the candidate must complete all three levels of CFA examination along with 4 years of relevant professional work experience

-

Which are the exam windows of CFA?

CFA Level I exams are conducted quarterly in the month of February, May, August & November.

CFA Level II exams are conducted in the month of February and August.

CFA Level II exams are conducted in the month of February and August.

CFA Level III exams are conducted in the month of May and November.

-

What is the passing rate of CFA Exams?

On an average 40% candidates’ clear level 1 and level 2, and 50% clear level 3.

-

Do the candidate need a passport?

When registering for the exam the candidate need not to have a passport, however the candidate needs the passport when appearing the exam.

-

How long will it take to complete the CFA program?

CFA full form is Chartered Financial Analyst. CFA certification is one of the highly valued and in-demand courses with plenty of career and job opportunities.

The CFA certification has three levels exams

- Level I

- Level II

- Level III

Candidates must complete these three levels in order to be certified as CFA professionals. In order to complete the CFA certification program, candidates take an average of three to four years in general. The course duration is entirely subjective to the candidate’s skills and abilities.

It is advised that aspirants spend a minimum of 300 hours to clear each level. Most candidates prefer to take the three-level exams in a row and complete them in a span of 18 months at a minimum.

-

Who is eligible for CFA?

CFA full form is Chartered Financial Analyst and the certification is issued by CFA Institute. Aspirants willing to take the CFA program should satisfy the eligibility criteria set by CFA Institute.

Here is the eligibility criteria list for CFA Program:

- Candidate must have a graduation or equivalent degree to enroll in CFA program

- Candidate doing their final year of graduation are also eligible for CFA Level I registration

- Candidates must have at least four years of work experience at the registration time.

-

What is the CFA Charter?

CFA charter is the designation given by Chartered Financial Analyst Institute (CFA Institute) to those who cleared their CFA certification program. CFA charter is a highly in-demand and valued credential in all MNCs and the Big 4.

Being a CFA charter opens up doors to a plethora of career opportunities. CFA charter is mainly hired to use their skills and knowledge throughout the finance industry for various job titles.

Becoming a CFA charter is hard and demands a lot of hard work and dedication to complete all three levels of the exam. But with a proper study plan, preparation, mock tests, and revision, it will be a piece of cake for the candidates to crack all three levels on the first attempt.

-

Is CFA better than MBA?

CFA stands for Chartered Financial Analyst and the certification is issued by CFA Institute. MBA full form is Master in Business Administration.

The main difference between CFA and MBA comes in the point of the acquired skill sets. Skill sets taught by CFA and MBA are entirely different. CFA is mainly regarding investment analysis, corporate finance, Portfolio management, and asset allocation. On the contrary, MBA mainly concentrates on a candidate's management skills like operations, Human resources, finance, and marketing.

The cost of getting your MBA certification is also higher compared to CFA certification. The CFA course is best when you want to form your career in the investment management field, while the MBA course is best if you desire you to have diverse experience in the field of management, operations, finance, etc.

So the career options of both CFA and MBA will also be quite different. Finally, the option entirely rests on the candidate’s goals, ability, skills, and salary desired.

-

Can I take the Level II exam before taking Level I?

CFA (Chartered Financial Analyst) certification course has three Levels. Candidates have to clear all three levels to get the credential of the CFA Charter.

All three levels must be taken in order. The candidate will not have the option to leave one level and start with the other. One must pass the Level I exam in order to take the Level II exam followed by Level III.